Learn about Car Trade-In

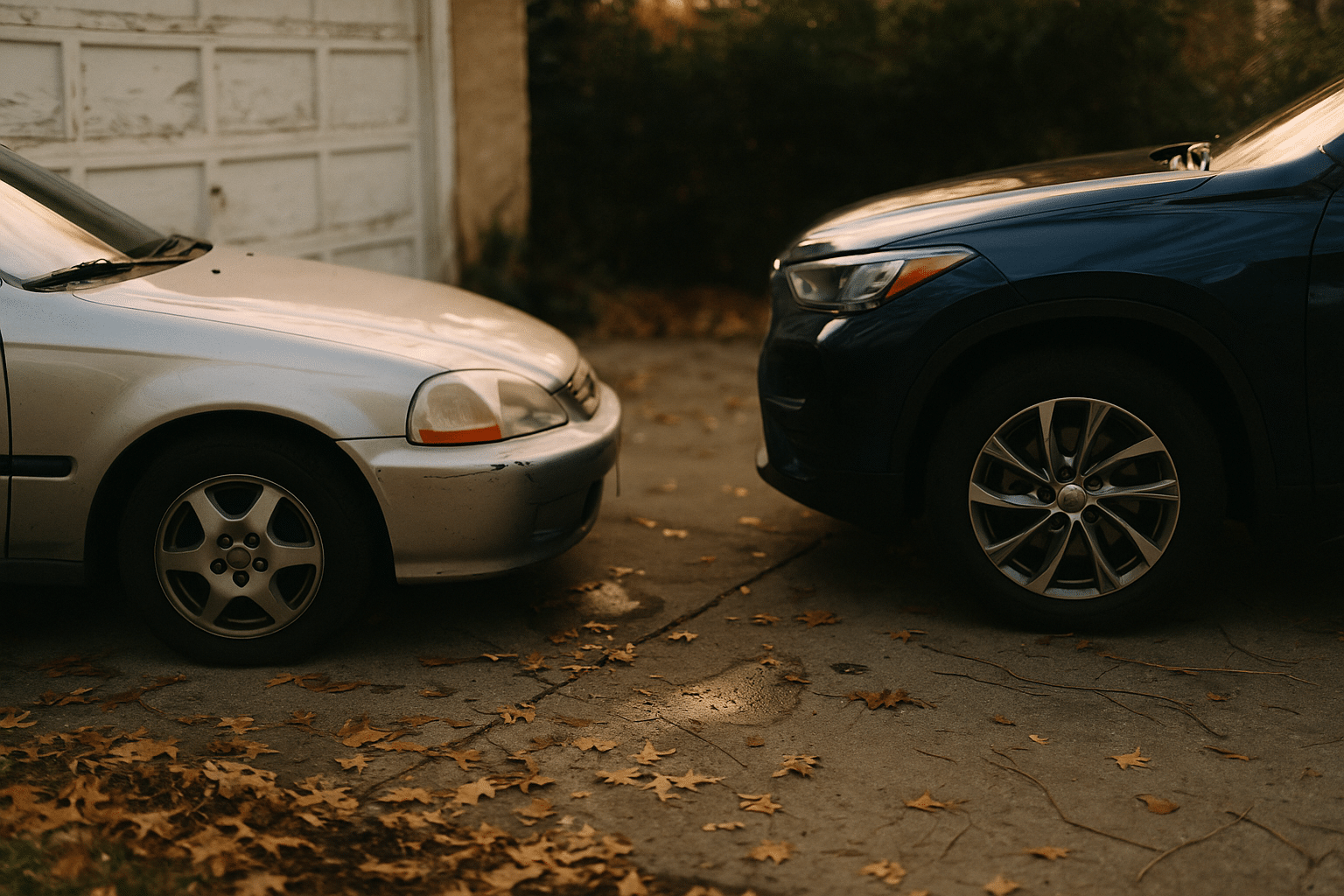

Trading in a car seems simple on the surface: hand over keys, sign a few papers, and drive away in something different. Underneath that convenience sits a careful calculation by the store taking your vehicle and a set of choices that can either protect or erode your equity. Understanding how your car is valued, when to trade, how to prepare, and how to structure the deal can turn a routine swap into a financially sound move that fits your budget and goals.

In today’s market, used vehicles continue to anchor many purchase decisions, and trade-ins remain a common path for drivers who prefer speed, sales tax advantages where applicable, and a single transaction. This guide breaks down the moving parts so you can make clear-eyed decisions without the stress.

Outline:

– How trade-ins are valued and why offers differ from private-party prices

– Practical prep that boosts offers without overspending

– Timing strategies, market trends, and dealing with equity

– Negotiation, paperwork, and deal structure essentials

– A step-by-step action plan and conclusion

How Trade-Ins Work: Valuation, Dealer Economics, and Tax Benefits

Trade-in value starts with what a dealer believes your vehicle will bring after it’s reconditioned and resold. That projection blends several inputs: local supply and demand, recent wholesale auction results, seasonality, transportation and floorplan costs, and the cost to make your car retail-ready. Since the store carries risk and overhead, the offer you receive usually sits below private-party value; the difference funds reconditioning, margins, and the possibility of slower-than-expected resale.

Consider a straightforward example. Suppose your car could sell privately for around 17,000. A typical trade-in offer might land near 14,500, reflecting a cushion for a detail, light service, minor cosmetic fixes, a safety inspection, and market risk. However, in many U.S. states, sales tax is calculated after subtracting your trade-in credit from the new vehicle price. If you buy at 30,000 and your state rate is 7 percent, trading in at 14,500 reduces the taxable amount to 15,500, saving about 1,085 in tax. Suddenly, the net gap between a private sale and a trade narrows from 2,500 to roughly 1,415, before accounting for your time, listing fees, and any private-sale repairs or delays.

Not all regions apply a trade-in tax credit, and rules can vary, so it’s important to verify local policy. Where the credit exists, it can tilt the math strongly toward trading, especially on higher-priced purchases. Additionally, convenience has real value: a trade-in often avoids weeks of messaging, test drives, and paperwork headaches associated with private sales.

Be mindful of equity. If your loan payoff is 16,000 and the offer is 14,500, you have 1,500 in negative equity. Rolling that into a new 60-month loan at 7 percent adds around 30 per month for every 1,500 financed (payment factor near 0.01986 per 1,000), and you’ll pay interest on it. Conversely, if your offer exceeds the payoff, the surplus reduces your next loan or increases your down payment. The key is to view the offer in a full context: tax credits where applicable, time and hassle avoided, reconditioning costs you would have shouldered for a private sale, and the financing impact of positive or negative equity.

Practical tip: ask how the store priced your car. You may hear references to typical reconditioning items—brakes, tires, fluids, detailing, and paintless dent repair. If you’ve already addressed some of these with receipts, you can sometimes nudge the number upward because the store’s risk and costs are lower.

Pre-Trade Prep That Pays: Low-Cost Fixes, Documentation, and Presentation

First impressions affect appraisals. A clean, well-documented car signals lower risk, and lower risk translates into stronger offers. You don’t need to perform a full restoration; focus on affordable touches that improve how the vehicle looks, feels, and drives during a quick appraisal loop.

Exterior and interior care: a thorough wash, clay, and wax can reduce the appearance of light scratches and oxidation; a 15–30 headlight restoration kit often brightens hazed lenses, improving both appearance and safety; a 60–120 interior detail (or a few hours of DIY cleaning) removes stains and odors that can spook buyers. Tiny paint chips on the hood or door edges may benefit from careful touch-up, but skip resprays unless severe damage is dragging the number down.

Mechanical quick wins are the hidden champions. Replace worn wiper blades, burnt bulbs, and cabin filters; top off fluids; and ensure tire pressures are even. If a modest alignment or balancing removes a steering shimmy, it’s worth it. Addressing a minor check-engine light may only require a gas cap seal or a simple sensor replacement; if the fix is unclear or expensive, disclose the issue honestly and weigh whether the expected increase in offer will exceed the repair cost.

Documentation matters. Bring service records, the owner’s manual, a spare key, original floor mats, and any accessories included at purchase. These details can add perceived value because they shorten the reconditioning checklist. If available, a recent independent inspection communicates transparency and can preempt low-ball adjustments for “unknowns.”

Practical checklist you can complete over a weekend:

– Deep clean: vacuum, wipe surfaces, clean glass, deodorize with a neutral product

– Exterior touch-ups: headlight restoration, light scratch reduction, tire dressing (subtle)

– Minor fixes: bulbs, wipers, fuses, cabin air filter, key battery

– Paperwork: title (or lienholder info), registration, payoff quote, service receipts, spare key

– Test drive: confirm smooth idle, straight braking, and no warning lights

Cost discipline is crucial. Spending 150–250 on cosmetic and minor mechanical items can sometimes yield 300–800 in offer improvement simply by reducing a dealer’s to-do list. On the other hand, big-ticket repairs rarely pay for themselves in a trade situation unless they dramatically expand the retail buyer pool (for example, resolving a major oil leak or failing brakes). Aim for high-visibility value: cleanliness, working basics, and documentation.

Timing, Market Conditions, and Equity: When to Trade and Why It Matters

Timing isn’t everything, but it can move your trade-in value by hundreds or more. Seasonality plays a role: all-wheel-drive SUVs and trucks often see stronger demand heading into colder months, while convertibles tend to shine in spring and early summer. Local conditions amplify these patterns—snow-prone regions lean toward winter-friendly vehicles, urban areas may reward compact, fuel-efficient models.

Mileage thresholds influence buyer psychology and pricing ladders. Values can step down around round numbers—30,000, 60,000, and especially 100,000 miles—because shoppers use these points to bucket vehicles by perceived risk and maintenance milestones. If you’re sitting at 98,500 miles and plan to trade soon, moving before six figures appear on the odometer can sometimes preserve notable value. Age matters too; as new model years arrive, previous years slide, and if supply of new inventory rises, used prices can soften as stores adjust.

Macro factors ripple through appraisals. Fuel prices affect demand for large versus small vehicles. Interest rates influence monthly payments, which in turn shape what retail buyers can afford and what dealers are comfortable offering. Supply trends—such as surges in off-lease returns or fleet sell-offs—can temporarily saturate certain segments, shifting offers downward.

Equity strategy ties it together. If your loan balance is close to your expected offer, you’re near break-even and timing tweaks can push you into positive territory. With positive equity, you reduce the new loan principal, possibly qualifying for better loan-to-value ratios and more favorable terms. With negative equity, you have choices: delay the trade to pay down principal, add cash to close the gap, or select a less costly replacement to contain the monthly impact.

Useful timing signals to watch:

– Odometer cliffs: consider trading before 60,000 or 100,000 miles if you’re close

– Seasonal demand: align your vehicle type with its peak shopping window

– Announcement cycles: new model introductions can nudge prior-year prices lower

– Personal calendar: trade before a registration renewal, major maintenance interval, or warranty expiry if it avoids extra costs

The goal isn’t to overoptimize; it’s to avoid predictable value dips. A month or two of planning often secures a cleaner outcome without turning the process into a part-time job.

Negotiation and Deal Structure: Separate the Numbers, Protect Your Equity

Strong outcomes come from clear structure. Break the deal into distinct parts—your vehicle price, your trade value, fees and taxes, and financing—and confirm each element separately before discussing monthly payment. When multiple variables move at once, it’s easy to give up value without noticing.

Start by gathering reference points. Obtain two or three appraisals from different stores or buying services and ask for written offers with expiration dates. Even a short-validity quote gives you an anchor. Then, at the store where you want to buy, request an itemized buyer’s order showing selling price, trade allowance, tax calculation, fees, and any add-ons. If a store combines figures into a single “difference,” politely bring the conversation back to line items; it’s your right to see the math.

Sample phrases that keep things simple:

– “I’d like to confirm the out-the-door price before we talk financing.”

– “Can we review the trade-in offer on its own and what reconditioning assumptions are included?”

– “Please list title, documentation, and any optional products so I can choose what to include.”

Mind the payoff. If you have a lien, bring a current payoff letter with a per-diem interest amount so the store can cut an accurate check to the lender. Confirm whether any negative equity will be paid in cash or added to the new loan, and ask your lender or the finance manager for the exact monthly impact. As a rough guide, at 7 percent for 60 months, every 1,000 financed adds about 19.86 per month.

Optional products—service contracts, protection packages, and similar items—are choices, not requirements. Evaluate them on price, coverage, and your actual needs. If you’re financing, remember these items become more expensive over time because you pay interest on them. You can typically decline or shop them later if you change your mind.

Finally, keep communication friendly and firm. Stores appreciate prepared customers, and transparency tends to speed things up. If your offer is meaningfully higher elsewhere, share the written appraisal and invite a match. If they can’t meet it, you still win—you’ve confirmed market value and can sell the vehicle to the higher bidder or use the quote as leverage.

Conclusion and Action Plan: Turning Your Trade-In Into Real Savings

Knowledge converts a routine trade-in into a controlled, value-focused transaction. You don’t need insider connections—just a plan and a little time. Here’s a simple, one-week roadmap that most drivers can follow without stress.

Day 1: Collect records and establish a baseline. Locate the title or lienholder details, registration, service receipts, and spare key. Pull a current payoff quote if you have a loan. Walk around the car and make a list of cosmetic and mechanical items that are cheap to address.

Day 2–3: Execute high-impact prep. Deep clean the interior, wash and protect the exterior, restore headlights if needed, replace wipers and bulbs, set tire pressures, and clear small issues. Keep spending modest and targeted; the aim is presentation, not perfection.

Day 4: Get multiple appraisals. Visit or submit details to two or three local stores or buying services and request written offers. Ask what reconditioning they assumed and whether that can be adjusted based on your receipts and prep. Save the highest quote as your leverage piece.

Day 5: Price the replacement vehicle separately. Confirm an out-the-door price—vehicle, tax, and all fees—before mentioning the trade. With the selling price locked, introduce your trade and compare the store’s offer to your best written appraisal. If there’s a gap, ask whether they can match or come close, especially if your car is a strong fit for their lot.

Day 6: Structure financing carefully. Decide whether to use a bank or credit union quote you bring in, the store’s offer, or cash. If negative equity exists, calculate the exact monthly effect and consider adding cash to minimize roll-in. Decline products you don’t need; select only those that provide clear, documented value at a fair price.

Day 7: Review paperwork. Verify the buyer’s order, trade allowance, payoff amount, and tax calculation. Confirm any promises in writing. Photograph the odometer and keep copies of everything, including a receipt indicating the store will satisfy your lien if applicable.

Common pitfalls to avoid:

– Chasing monthly payment without confirming price, fees, and trade value

– Overinvesting in repairs that won’t move the appraisal number

– Rolling negative equity without understanding long-term cost

– Assuming sales tax credits apply without checking local rules

By separating the numbers, preparing your car, and timing the swap with simple signals, you protect your equity and cut friction. Whether you value speed, lower tax where applicable, or a tidy one-stop transaction, this approach helps you trade with clarity and confidence—and keep more of your hard-earned money working for you.